A frugal stay at home mom shares her best tips for stay at home mom budgeting and saving money – so you can be home with your kids instead of away at work.

I ’m so excited to share something dear to my heart with you Affording Motherhood followers – SAVING MONEY! My husband and I made it a goal to pay off our house in 7 years (with a 15-year note), so I would be able to stay home with our kids when the time came, so saving is my best friend.

We were both teachers and did not have kids yet. We doubled up on payments for a while and then started paying more and more, beating our goal by 4 years and paying it off in 33 months (A $110,000 loan)!

8 Stay at Home Mom Budgeting Tips

Here we are, years later and I’m a stay-at-home mom with no debt, still saving for college and retirement. So here are some stay at home mom budgeting tips I find useful to show you how to financially prepare to be a stay at home mom!

1. Make a Budget

This is the #1 way to start saving. Why? Because you see exactly where your money goes and how much spending you can reduce when it’s laid out in front of you.

Once my husband made me control more of the budget, I really started saving money. I’m amazed by how many people don’t have a real budget.

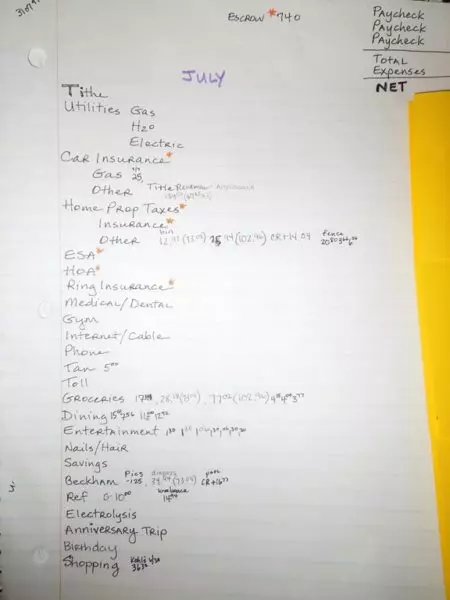

When I say “budget,” I’m talking three important things on it: Category (i.e. Groceries), Budgeted Amount ($400), and Every Expenditure (every trip to the store that was for groceries (see our budget below).

I could go on and on about a budget, but the main thing is to get one in writing and start using it. You will be amazed at how much you’re spending and how clearly you can see your money.

Trust me, I know how easy it is to let the credit card statement be your budget. We’re CONSTANTLY revising our budget…and we get better and better each time!

2. Get Rid of Cable

I’m talking the big, crazy packages most families have. We haven’t had cable since we got married. No Netflix, no DVR, no HuluPlus. I feel so out of the loop when people talk about “cable shows.”

We watch a ton of movies. We also buy seasons on DVD (or ask for gifts) and watch them in the summer!

This is an easy way to save a lot of money each month. I’ll be honest…I wish we had DVR so I could record shows, but I like saving money so I can stay home with my baby much better. We pay $69 for the Internet AND Basic Cable (have to have this for TV).

3. Shop Around

Shop often for different rates for insurance and electricity. There is almost always a better deal out there. My husband changes electricity companies, almost monthly, for the best rate. I think that’s a bit extreme, but he’s in charge of that.

Texas summers are brutal, so A/C is a must! We keep it at 77-78 degrees in the summer and our bill is between $100-175 a month (for a 2000 sq ft house).

4. Cut Groceries

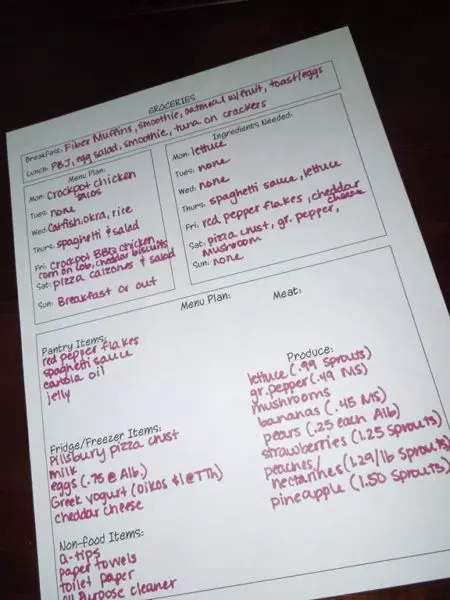

I love food so this one is hard for me, but most Americans overspend on groceries. I know this will differ for each family, but my rule of thumb is $100 per person in the household.

We have three, so we should spend about $300. We actually spend around $360 (this is everything except diapers). I’m hoping when we have more kids, we’ll stick to that rule of thumb.

When Ryan and I were first married we spent $280 a month. You can check out my detailed tips for grocery shopping here. Menu planning and ads are key for us.

5. Minimize Dining Out Money

I love to eat out! Therefore, we have to find ways to save in this category. I have tons of tips here. Coupons are the key for us in this department. We budget about $100 a month for dining out (this includes fast food, restaurants, and my must-have Starbucks every once in a while…any food outside the house).

6. Spend Wisely

We are stewards of God’s money here on Earth, so how we spend it is important. This simple equation will help you manage your money:

Income > Expenditures = Good Budget

Sounds easy, but surprisingly, the majority of Americans do not follow it, hence the debt crisis. Viewing money differently is important to saving.

If you want to save BIG, there are TWO major things you should focus on: HOUSE and CAR. I won’t go into detail here, but the following are important for each.

7. Purchase a House with Care

The key is to buy the right house first. Your mortgage should NOT be more than twice your household’s total annual income. For example, if your household income is $80,000, your loan should not be more than $160,000. Of course, this a general rule, but the point is, your mortgage should be lower than you think it would be (definitely lower than what most Americans buy). Also, get a 15-year note!

8. Pay Cash for Your Car

Never lease! It’s the most expensive way to operate a vehicle. Do not take on car payments. This post says it all. I love what Dave Ramsey (whom we follow for financial advice) says about this: “Will your broke relatives and friends make fun of your junk car while you do this? Sure they will, but that is a very good sign you’re on the right track.”

How to Be a Stay at Home Mom on One Income

Here’s a recap of how to budget and save money to be a stay at home mom.

- Make a Budget

- Get Rid of Cable

- Shop Around

- Cut Your Grocery Budget

- Minimize Dining Out

- Spend Wisely

- Buy the Right House

- Pay Cash for Your Car

What are your favorite money saving and budgeting tips for your family?

Olivia Snyder is the writer at Joyfully Prudent: Prudent Living, Simple Solutions, Joyful Journey. The blog is a culmination of all things Snyder (finance, money saving tips, family, recipes, and more). She’s a former teacher, called into being a stay-at-home mom to her adorable children. She spends her “free” time blogging, making printable signs for Joyful Art Designs (on Etsy), and playing soccer. She and her husband live in Texas. God is good!