Today, I want to share a tip for not just creating a budget, but for sticking to it by creating a “sinking fund” for your personal budget. This technique will help you plan ahead for unexpected expenses. Plus, I’ll show you exactly how to manage a sinking fund within your bank accounts and budgeting software!

What is a Sinking Fund?

One of the biggest challenges to staying on budget is dealing with all those little extra expenses that seem to pop up. I’m not talking about the big emergencies when the basement floods or you get laid off. No, these are the little costs that always seem to sneak in.

It might be the car that needs tires, or that side of beef you want to buy, or the wedding gift for your niece that takes you by surprise.

The problem is that these are expenses that fall outside our regular monthly expenses, so it can be easy to forget to include them in our budget.

They aren’t true emergencies, but we often end up dipping into our emergency fund, or worse yet using a credit card, to cover them.

(Here’s a list of common unexpected expenses that you might want to include in your sinking fund budget.)

So, what is a sinking fund? No, it doesn’t have anything to do with sending money down the drain!

With a sinking fund, you plan ahead for these expenses by saving a little each month. This way you have all you need for those new tires without borrowing from your emergency fund.

How to Manage a Sinking Fund

My husband and I keep a sinking fund for those often forgotten budget categories. This practice has made a big impact in helping us consistently stay on budget.

Even once we learned how important it was to use sinking funds to budget for these unexpected expenses, it took several more months to figure out the best way to go about managing all these little pots of savings we had squirreled away.

We’ve recently realized that we need to get even more serious about tracking and managing our sinking fund. Up until now we’ve tracked those funds digitally using Mint.com, but they’ve been lumped together, floating somewhere between our checking and savings accounts.

We have recently decided that they need a home of their own. In the event that we do have a true emergency or we go over budget for whatever reason, we don’t accidentally use up the sinking fund. We need to be able to count on that money being there to cover our non-monthly expenses.

It is also important for us to have a clear picture of how much we have in savings as we work towards building our 6-month emergency fund.

I once saw a post from one frugal living blogger who kept something like 14 separate bank accounts to manager all her different sinking funds! But you all know I like to keep it simple!

My husband and I keep a sinking fund for 22 of those often forgotten budget categories. There was no way I’m going to manage 22 different bank accounts. So, here’s what we’re doing instead to track and manage our sinking funds.

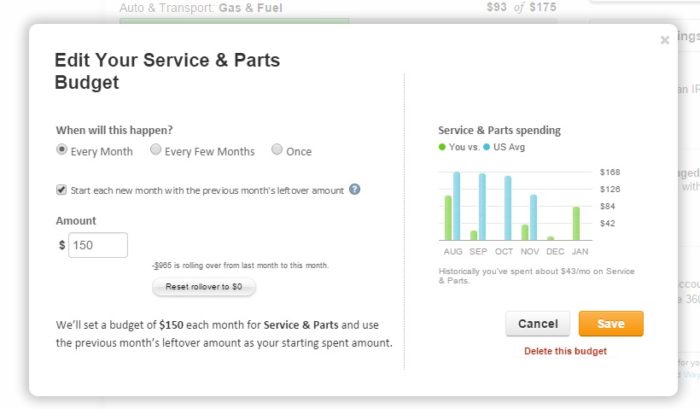

First off, we track each of these funds digitally using Mint.com. When you create a budget for a category that needs a sinking fund in Mint, select the “Every Month” option and make sure to check “start each new month with previous month’s left over amount”.

Here’s a screen shot, so you can see what I mean…

You can see that for this sinking fund we are rolling over $965 from last month and we’ll be adding $150 this month.

At the end of the month, any amount from that $150 that was unused will be moved into a separate savings account that holds the money for all our sinking funds combined. We can do this, because Mint helps us track those separately, without actually having separate bank accounts!

Alternately, if we needed to spend more than $150 for a big car repair this month, we would move money from our sinking fund into our checking, and this also is automatically tracked on Mint.

Our plan is to create a new linked savings account to hold our sinking fund which will be separate from the savings account we already have. This may seem like a small shift, but it is something that will give us both a lot more financial peace.

Update: We have now created our separate account for our sinking funds, and I’m using a spreadsheet to track how much needs to be moved in or out of the account each month. It’s working beautifully and has added so much peace of mind to our budgeting!