Wondering how much to budget for utilities? This article will show you how to be spot on with your utility budget every month — even when costs fluctuate between high and low, with average utility bill amounts for families.

When my son was little, we called him the Prophet because it often seemed as if he could tell the future. One day when we were driving to visit Nana and Papa, he said to us from his car seat, “Why is that car upside down?”

We didn’t see any car upside down and forgot about it until we were on our way home, and sure enough, there was a terrible accident with an overturned car that hadn’t been there before. Ever after, we made sure to pay attention to any strange things this little guy said.

Don’t you sometimes wish you could tell the future…especially when it comes to your budget? It seems that some expenses are so unpredictable that they are always threatening to turn your budget upside down.

One budget category that can be particularly difficult to plan ahead for is utilities. Sometimes they’re high, and other times they’re low. When they’re cheaper, it seems you should save for the seasons when they’re high, but how much? How can you figure utility costs into your budget when you never know exactly what they’ll be in the future?

Two ways to know how much to budget for utilities

Today, I’ll share two simple strategies for how to estimate utility costs that will make it almost seem as you have the super-human ability to know the future, so you’ll always be ready to cover those costs. The first is the strategy of “Make a New Budget Every Month,” and the second is the concept of “Dollar Cost Averaging.”

The “Make a New Budget Every Month” Strategy

If you’ve been through the Budget Myths Mini-Course, you already know that you should make a new budget every month. (And if you haven’t, you can join the course for free right here to learn more.)

Don’t worry; you don’t have to start from scratch. Most things will stay pretty much the same from month to month, but for costs that fluctuate like utilities, it’s helpful to revise your budget monthly to reflect your actual expenses.

For example, I got my electric bill on the 30th of December to be paid by the 15th of January. I revise my budget before the beginning of January to reflect the actual costs, so I’m always spot on, even for bills that aren’t the same every month.

How to Budget Utilities with “Dollar Cost Averaging”

But what about if your utilities vary drastically from one season to another. If you’re like us and have a cold, snowy winter that requires lots of heat, but a mild summer, your utility costs could be twice as much in the winter.

Or you could have just the opposite if you have hot summers and mild winters. The higher months can really eat into your overall budget. Instead of planning one month at a time, you can use Dollar Cost Averaging to make your utility bills constant throughout the year.

This is an investment term, but the idea is the same. You take your utility costs and average it over the year to give you one flat rate to budget every month. This is a great way to stress less about your finances because you know that your more expensive utility bills will be absorbed into your budget during the months when they’re lower. But how do you know what your average utility costs are?

“Budget Billing” Programs

Some utility companies offer programs that do this for you. At my electric company, it’s called “Budget Billing.” They set an estimated average, and you pay them equal payments throughout the year. This is probably the easiest method.

When utility costs are low, how much do I save for when they’re high?

However, I like to keep my money in my pocket as long as possible (might as well be earning interest). If you feel the same way, you can take steps to set up the same concept of Dollar Cost Averaging for your utilities within your own accounts.

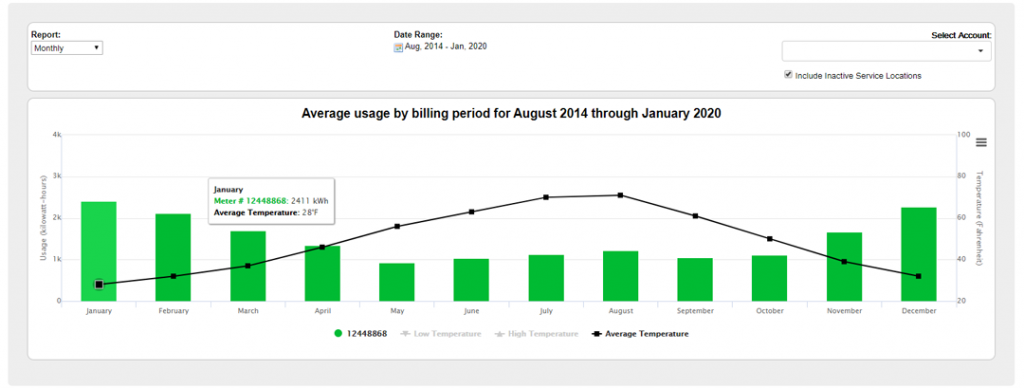

First, find your average utility cost. To do this, you can look back at your bills over the last year.

If, however, you haven’t been in your house longer than a year, contact your utility company and see if they can give you the high and average costs for your home. This is also great to do when you’re looking at renting or purchasing a new home, so you have a more accurate idea of how moving will impact your budget.

Second, when you’re in the lower-cost season, set aside your utility average every month. You’ll pay your utility bill as usual and then save anything that’s leftover in a Sinking Fund.

Let’s look at an example

For instance, imagine your annual average is $200 per month, but it’s May, and your bill is only $90. You’d pay the $90 bill to the utility and then set aside the remaining $110 in a savings account to use for the higher-cost months. By the time December rolls around and your heater’s humming, you’ll have no problem paying the bill without impacting the rest of your budget.

How much does the average family spend on utilities per month?

We all like to know how we measure up, especially on our budgets. But no one ever discusses this stuff in real life, do they?

I polled some of my Budget Breakthrough students to satisfy your curiosity, and the average cost of utilities per month was $533 per month. This is slightly higher than the national average of $428 per month for a family of four, according to the Bureau of Labor Statistics.

Of course, there was a wide range of utility costs for families ranging from just $197 all the way up to $1,278. Some live in apartments while others are in houses. Some have large families and others are single moms.

Here are the utility costs for the average 4-person household in the US:

- Natural Gas, $44 per month

- Electricity, $151 per month

- Other fuel sources (Heating Oil, Pellets), $10 per month

- Home Phone, $16 per month

- Mobile Phone, $140 per month

- Water and Other Public Services (Sewer, Garbage), $68 per month

Not every family in my survey had all of these individual costs, so I didn’t get a representative average for most. However, one thing that almost every family listed was Mobile Phone expenses which averaged $188 per month. (They ranged from a low of $36 to a high of $305.)

In addition, you may also have other utility expenses including:

- Internet

- Television (Cable or Subscriptions)

- Security/Alarm

Your best bet is still to figure out your own average utility bill and plan accordingly. Then you can compete against yourself and see if you can find ways to cut it down if you want to.

Is it worth the hassle to figure this out?

Now, you could take a look at this and say, it seems like too much trouble. Do I really need to plan my budget in that much detail? Won’t it be a lot of work to make a new budget every month? And you’d be right.

It does take a few minutes more to revise your budget each month. And if you want to put these strategies into action, you’d need to pause your busy life and figure out your utility password or pick up the phone.

However, the rewards are well worth it when expensive utility bills arrive in your mailbox, and you know you already have the funds available to cover them.

You’ll be like a squirrel gathering acorns. He eats some now (pay your current bill) while stashing away the extras for the cold, snowy months (saving a little extra now for your peak utility bills later in the year).

The alternative is to keep up business as usual and then get blindsided by high utility costs throughout the year. It’s then that you’ll end up feeling panicked or have to shave other budget categories down to a minimum to cover it.

So, let’s review these two simple ways to budget utilities

Instead of ignoring your utility budget and hoping for the best, you can plan at least one month ahead by making a New Budget Every Month. Because you get your bill ahead of time, there’s no trouble estimating what the cost will be. You can plug the exact number into your budget and adjust other categories accordingly.

If you want to take it one step further, average your utility costs over the year and set aside the difference in a savings account to prepare for high-cost heating and cooling seasons — so you’ll never feel stressed about covering another utility bill.

I guess we’ll never know whether my son’s ability to “see the future” was coincidence or if it was something more, but you can plan your utility budget so well that it seems that you too know exactly what’s coming.

Now’s the time

Take a few minutes to prepare next month’s budget and include your exact utility costs, or even better log on and find out your average utility costs and make a plan to save for peak seasons now. Your future self will thank you.

If you’re ready to dig deeper into budgeting the right way, join the free 6 Budget Myths Mini-Course that will help you to avoid common budgeting mistakes and learn what to do instead.