Discover how to use the Dave Ramsey debt snowball with this free debt snowball example video. Make small changes to get out of debt months or even years faster!

I am so excited to share how to use the debt snowball calculator with you because I believe that, not only will it help you with the cold hard numbers, but it will also help you get motivated to be debt free!

Once you see how paying even a small extra amount toward your debt can cut months off your debt payback, you’ll be inspired to save more and more. At least, that was how I felt when we were working on paying off our $22,047 in student loan debt.

This is a great free tool to help you get out of debt faster. However, I’ve found that it can be a little hard to find and use if you don’t know what you’re looking for. Even though I’ve used it more than is probably healthy, I always find myself clicking around trying to locate it.

Once you finally find it, it isn’t immediately apparent how to make use of the full power of this free tool. Today I want to show you exactly how to get there, and how to use the Debt Snowball Calculator, so I’ve created a video and a picture tutorial below to get you started.

What is a Debt Snowball?

The concept of the debt snowball is to pay off your smallest debt first. Then use the money you were putting on the monthly payment from your first loan toward your next biggest debt, and so on.

It doesn’t exactly make sense mathematically. Wouldn’t it be better to start paying toward your highest interest loan first?

Maybe. Psychologically though, as you experience your first taste of success by paying off the smallest loan quickly, you’ll feel more motivated to keep finding ways to save money and earn money to put towards your loans until you’re out of debt.

Debt Snowball Example – How to Tutorial

You can watch the video tutorial below to see how to use the debt snowball calculator, or read the picture tutorial that follows. For the example, I’ll be using the starting amount that we had when my husband and I started our journey to debt free. Then, I use several examples of small budget adjustments that you might use to get out of debt faster. Be sure to plug in your own numbers to the calculator after the tutorial, so you can see exactly how this applies to your own situation.

1. First, go to the free debt snowball calculator.

Unfortunately, the debt snowball calculator I’m using on this video is no longer available on Dave Ramsey’s My Total Money Makeover site. However, there are several good debt snowball calculators now available online that work in the same way as shown in the video.

You may want to try the ones recommended by The Simple Dollar or Lifehacker.

Regardless of which spreadsheet or calculator you use, the basic steps to completing your debt snowball will be the same, as you’ll see below in my debt snowball example.

2. Once you’re there, click the orange “Add Debt to List” button. Then enter your smallest debt first.

You can type in a name for the debt, select the type (student loan, credit card, “stupid tax”, etc.). Also enter the current balance, minimum monthly payment, interest rate, and what day of the month you make your payment.

Then click save.

3. Repeat step 2 for all of your debts. List them in order from smallest to largest.

At some point it may ask you for your name and email address, so you can save your information. Even if you don’t choose to sign up, you can still keep using the calculator. Just “x” out of the subscription box.

4. Recurring Extra Payments

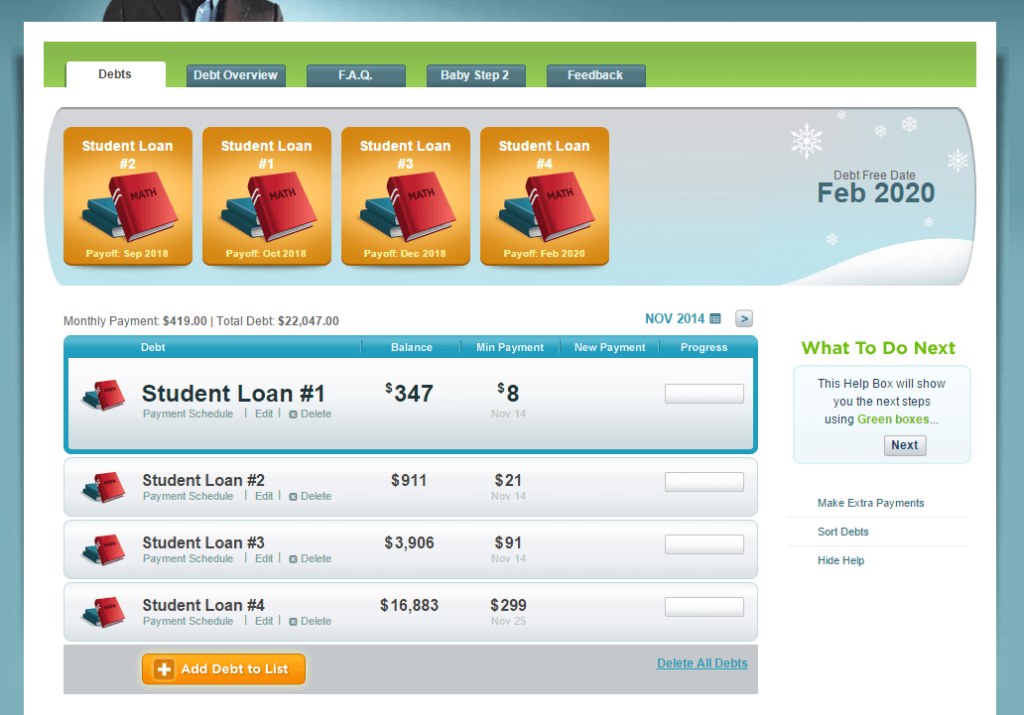

Now the magic really happens! You might notice that the Debt Free Date listed is February 2020. That’s great, but what happens if we start finding ways to make small extra payments toward the loans?

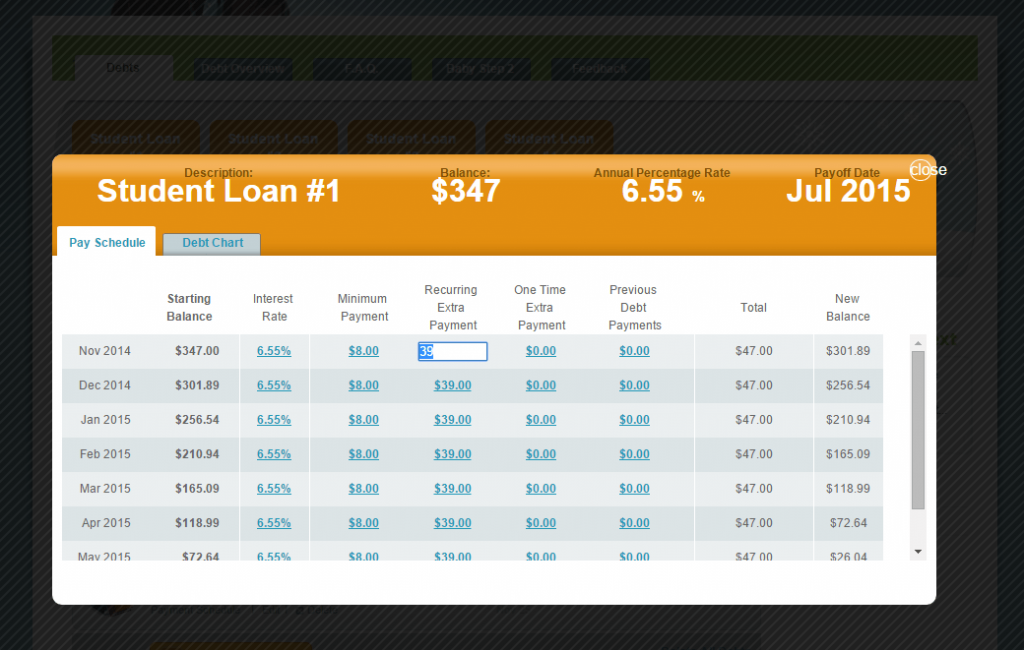

Click the little gray words that say “Payment Schedule” under your first loan. Then, enter a small extra payment in the “recurring extra payment” column. It doesn’t look like you can edit this at first, but just click on the “$0.00” text, and you’ll be able to type in your own amount.

This is how my husband and I took the first step to becoming debt free. We put just $39 extra toward our smallest loan, even though it didn’t have the lowest interest rate. (That only made math-loving self only slightly twitchy.)

The calculator automatically “snowballs” your previous minimum payment and any recurring monthly payments over to your bigger loans once the smaller ones are paid off.

That tiny extra payment just knocked 6 MONTHS off our debt payback. Hello!

I told you this tool was powerful.

So let’s keep going!

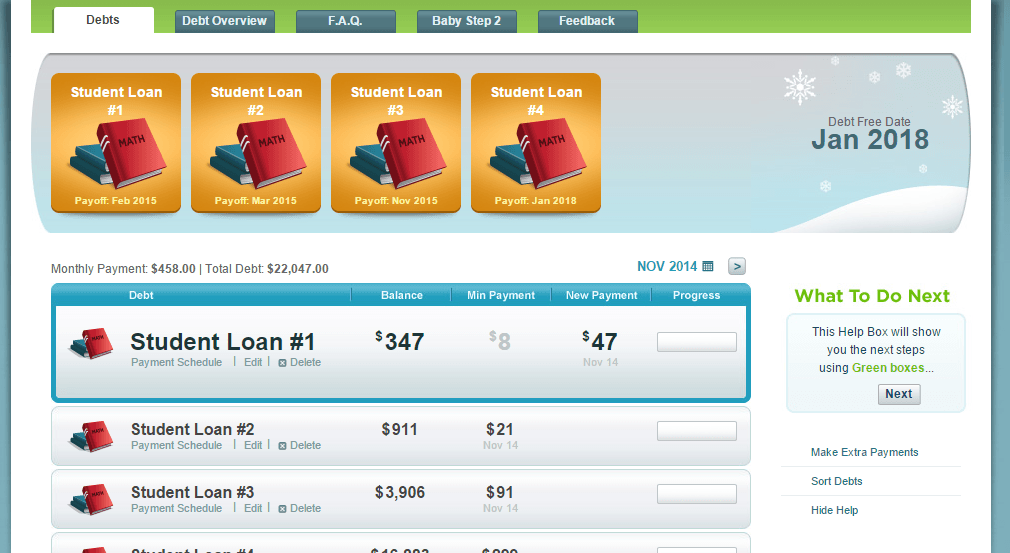

What if in October, you find a few more ways to start saving money that adds up to another $100 per month? I did this and more by finding simple ways to save money on groceries. During out debt payoff we spent at most $300 on groceries, and one month we spent just $170!

In November, you open an Etsy shop or write a short book for Kindle and start making an extra $50 per month.

Through these few little tweaks to your budget, you’re now on track to pay off your debt 21 months sooner than when you started!

5. One Time Extra Payments

We aren’t done yet! In February maybe you get a bonus at work and put all $1,233 toward your debts. Voila, you’re paying off that debt another 2 months sooner.

You should enter any one-time extra payments in the “one-time extra payment” column. At some point, you will have to move to Debt #2 to enter these amounts because Debt #1 will be long gone! You can then roll over the minimum payment and the extra monthly payments to your next loan. (This happens automatically in the calculator.)

You’re really excited about getting out of debt now, so in March you do a No Spend Month and save an extra $300. Nothing can stop you now. In April you do some spring cleaning and sell $200 worth of stuff you didn’t need. Maybe in May you get an $800 tax refund. Of course, all of this goes straight on your debt repayment!

You need to have a plan when these small windfalls come your way. Make the decision ahead of time: any extra income goes to paying off that debt! Otherwise, it can all too quickly disappear on small extra purchases here or there. Don’t waste the opportunity to make a big impact on getting out of debt fast!

Altogether, in quick and relatively painless fashion, you will be debt free over 2 years sooner!

Your Debt Snowball

Of course, this is an example using some random numbers. The real power of the Debt Snowball Calculator is when you log on and start looking at your own debt repayment plan. Play with the numbers, and start to see how even small changes in your budget can make a real difference. Then go crazy with getting out of debt! The sooner you start, the sooner you’ll reach your goal.

Have you tried the debt snowball calculator yet? How much faster can you get out of debt?